INCOME | IRD | TAX

Mileage tracking for landlords

Track kms, distributions, and learn the latest IRD tax rules for your trips.

Stay organised

Tracking your kilometres properly can reduce taxable rental income and simplify year-end

EVERYTHING NEEDS

Keep credible records easily

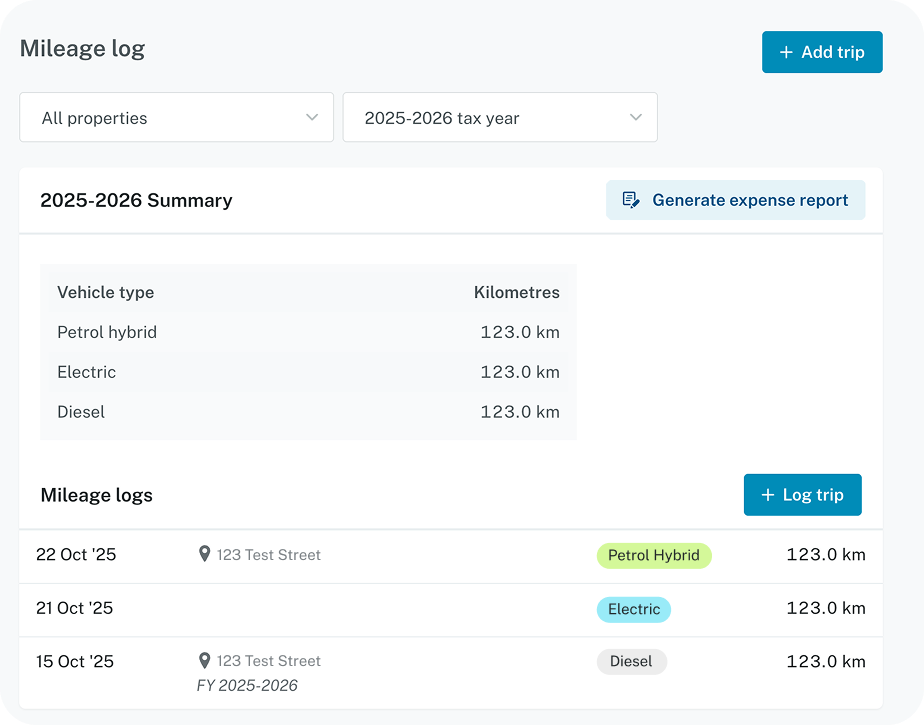

Good documentation can mean more deductions, fewer issues at year-end, and a stress-free return. myRent makes this process easier by providing a dedicated section for tracking all your rental property-related vehicle use and storing all records in one secure place.

Mileage logs

Date

2025-12-18

Property

123 Test Street

Tax year

2025-2026

Vehicle type

Petrol

Simple reporting

One-click accountant's report

Just like our Expense Tracker, at year-end your mileage records are in one place to be conveniently exported and passed to your accountant.

Stay organised

Start tracking your mileage and managing your rentals smarter today

Try myRent now with a 1 month free trial

Once the trial period ends you can manage your property for just $19/month + GST.

No contract, you can leave anytime.

No contract, you can leave anytime.

Explore more myRent tools

Not quite ready to sign up?

Subscribe to our weekly newsletter read by 40,000+ landlords. Get updates on important tenancy law changes, tips on maximising rental returns, and more great resources.